What is a Pip in trading

If you’re into Forex, you’ve probably heard of the term ‘pip’ or ‘pips.’ It’s a common concept in Forex trading, and understanding what a pip is can be essential. In simple terms, a pip is a unit of measurement used to express the change in value between two currencies. This article will break down the meaning of a pip and help you grasp this fundamental aspect of Forex trading.

WHAT IS A PIP IN FOREX TRADING

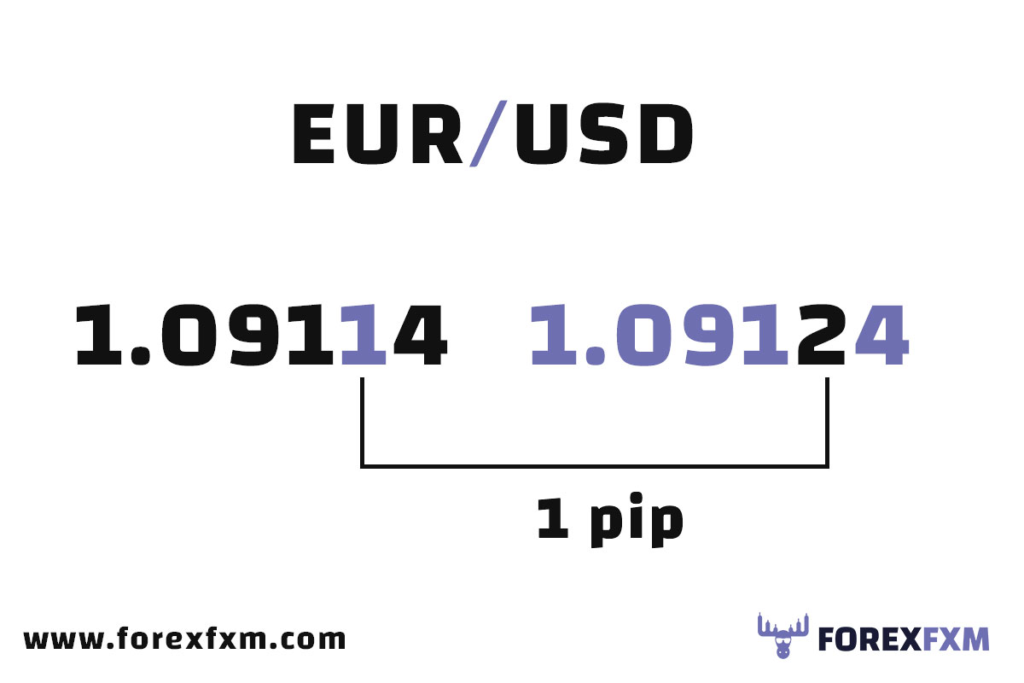

In Forex trading, a “pip” is the unit of measurement used to indicate the change in value between two currencies. It’s represented by a single-digit movement in the fourth decimal place of a typical forex quote. For instance, if the price of EUR/USD changes from 1.0911 to 1.0912 that’s considered a one pip or ‘point’ movement. Pips are crucial for traders to assess price changes accurately and make informed decisions in the dynamic currency exchange market.

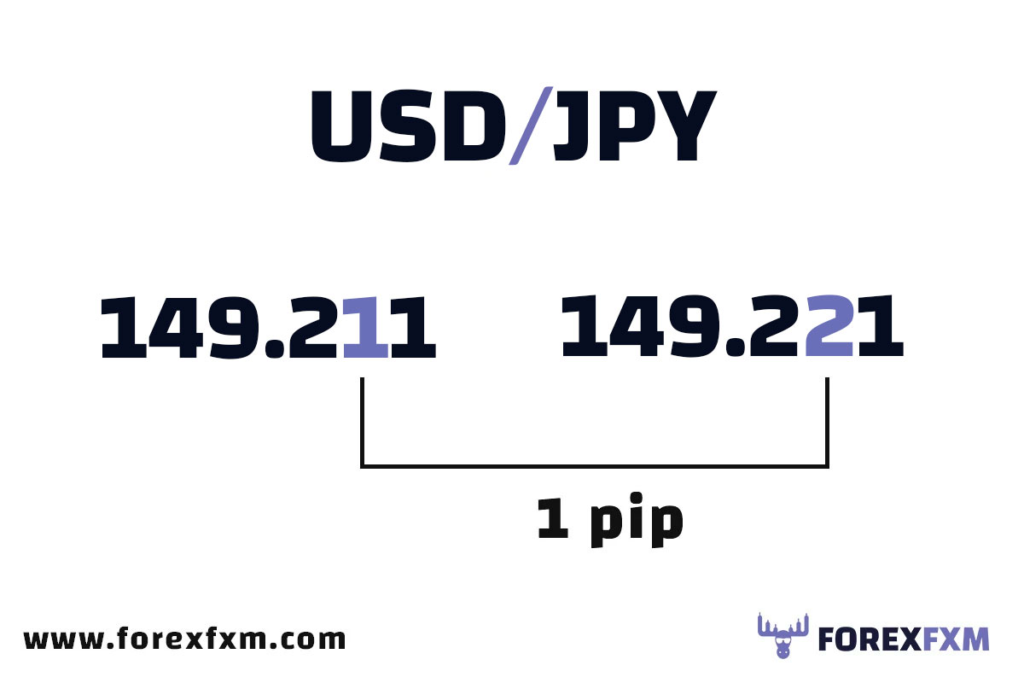

Exception are the JPY pairs

Unlike most currency pairs where a pip is the fourth decimal place, when trading the Japanese Yen, a pip is the second decimal place. This adjustment is necessary because the Japanese Yen has a much lower value compared to other major currencies.

Understanding this exception is crucial for traders working with the USD/JPY pair to accurately interpret price movements.

Despite this difference, the concept of pips remains a valuable and standardized measure. It allows traders to communicate in a uniform language, promoting clarity and avoiding confusion in the dynamic world of currency trading.

How do you calculate the forex price moves

Now, let’s demystify how these seemingly small price movements can translate into real monetary gains or losses. In this guide, we’ll break down the calculation of the monetary value of a pip, providing a practical example using the EUR/USD currency pair. Understanding this fundamental aspect is not just about numbers; it’s a key component of effective risk management in the dynamic world of Forex trading. Let’s dive in!

Step 1: Understand Pip Value Formula

Pip Value=Position Size×Pip Decimal ValuePip Value=Position Size×Pip Decimal Value

Step 2: Example Calculation

Position Size: Let’s say you open a position with a size of 10,000 units of the base currency (in this case, the Euro).

Pip Decimal Value: For the EUR/USD pair, one pip is typically represented as 0.00010.0001.

Plug in the Values: Pip Value=10,000×0.0001=$1Pip Value=10,000×0.0001=$1

Interpretation:

This means that for every pip movement in the exchange rate, your position gains or loses $1. If the market moves in your favor by 10 pips, you would gain $10. Conversely, if it moves against you by 10 pips, you would incur a loss of $10.

Importance:

Understanding the monetary value of a pip is crucial for risk management. It helps you determine the potential impact of price movements on your trading account and allows you to set appropriate stop-loss and take-profit levels.