What is Forex Trading

Forex trading, short for foreign exchange trading, is the decentralized global marketplace where participants buy and sell currencies. It is the largest and most liquid financial market in the world. In forex trading, currencies are traded in pairs, such as the US dollar (USD) against the euro (EUR).

The primary purpose of forex trading is to exchange one currency for another, anticipating changes in the exchange rates between them to make a profit. Participants in the forex market include individuals, financial institutions, corporations, and governments. Trading occurs over-the-counter (OTC), meaning it takes place directly between parties through electronic trading platforms or over the phone.

FOREX TRADING BEGINNERS GUIDE

Your starting point for understanding how money is exchanged around the world. In this guide, we’ll break down the basics and teach you the terms you need to know. It’s like learning the ABCs of Forex! By the end, you’ll be better equipped to make smart decisions in the exciting world of currency exchange. Ready to jump in? Let’s get started!

WHAT IS A FOREX PAIR?

In forex trading, a currency pair is formed by pairing up two currencies that are traded against each other. While there are numerous combinations available, some of the commonly traded pairs include the euro against the US dollar (EUR/USD), the US dollar against the Japanese yen (USD/JPY), and the British pound against the US dollar (GBP/USD).

What are base and quote currencies

When you look at a currency pair, the base currency is on the left, and the quote currency one is on the right. The base currency is always counted as one, and the quote currency shows how much it costs in the current market. It’s like saying, “How much of the quote currency do I need to buy one of the base?” So, in currency trading, you’re basically swapping one currency for another.

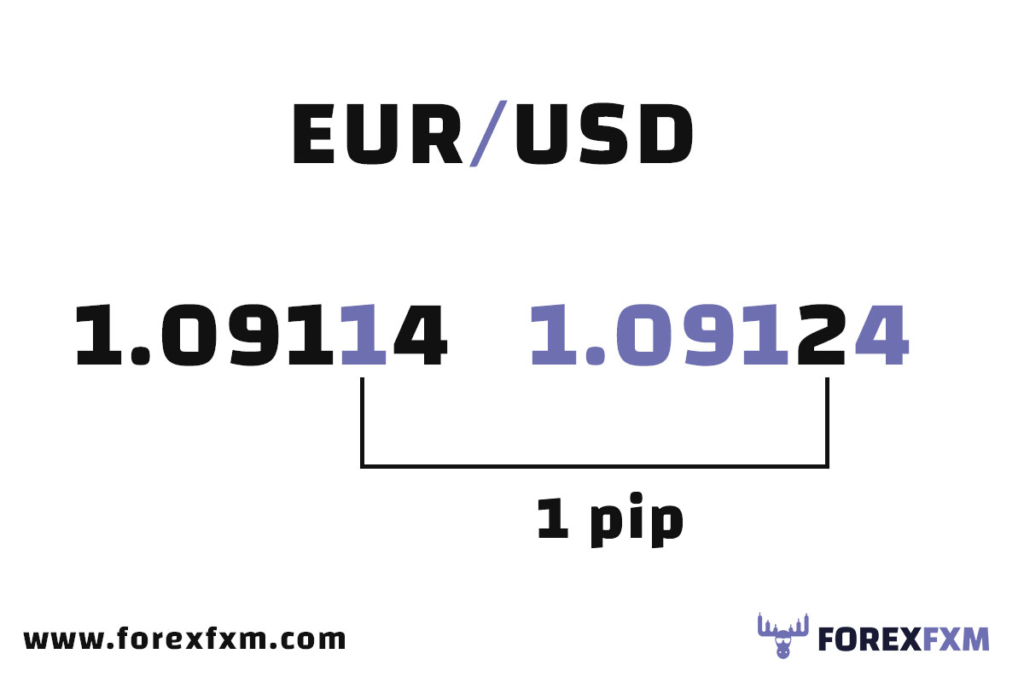

What is a pip in the forex market

In forex, a pip typically refers to a one-digit change in the fourth decimal place behind the comma (,) of a currency pair. For example, if GBP/USD moves from $1.23589 to $1.23590, it has shifted by one pip. However, when trading JPY crosses, a pip is a change at the second decimal place behind the comma. Additionally, a price movement at the fifth decimal place in forex is called a pipette.

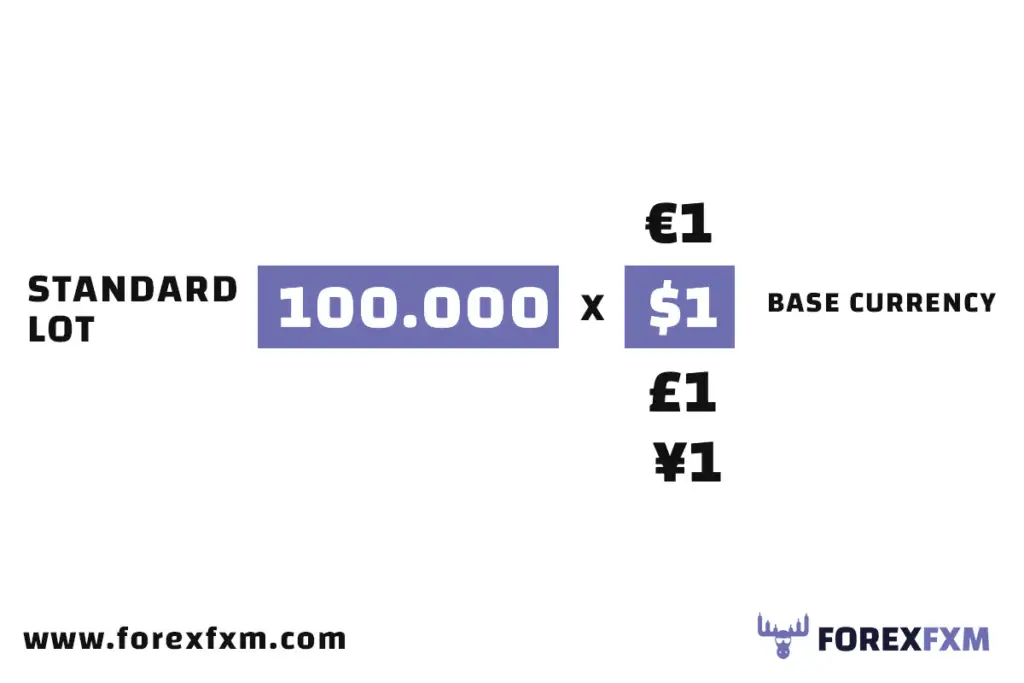

What is a LOT in Forex Trading

In forex trading, currencies are transacted in lots, standardized batches used to facilitate trades. Given that forex price movements are usually modest, lots are commonly substantial. For instance, a standard lot comprises 100,000 units of the base currency. Additionally, there are mini lots (10,000 units) and micro lots (1,000 units) that cater to traders seeking smaller positions.

HOW DOES TRADING IN THE FOREX MARKET WORKS?

Forex trading functions much like any other transaction involving the exchange of assets using currency. In the forex market, the market price informs traders about the quantity of one currency needed to acquire another. For instance, in the GBP/USD currency pair, the current market price indicates the amount of US dollars required to purchase one pound.

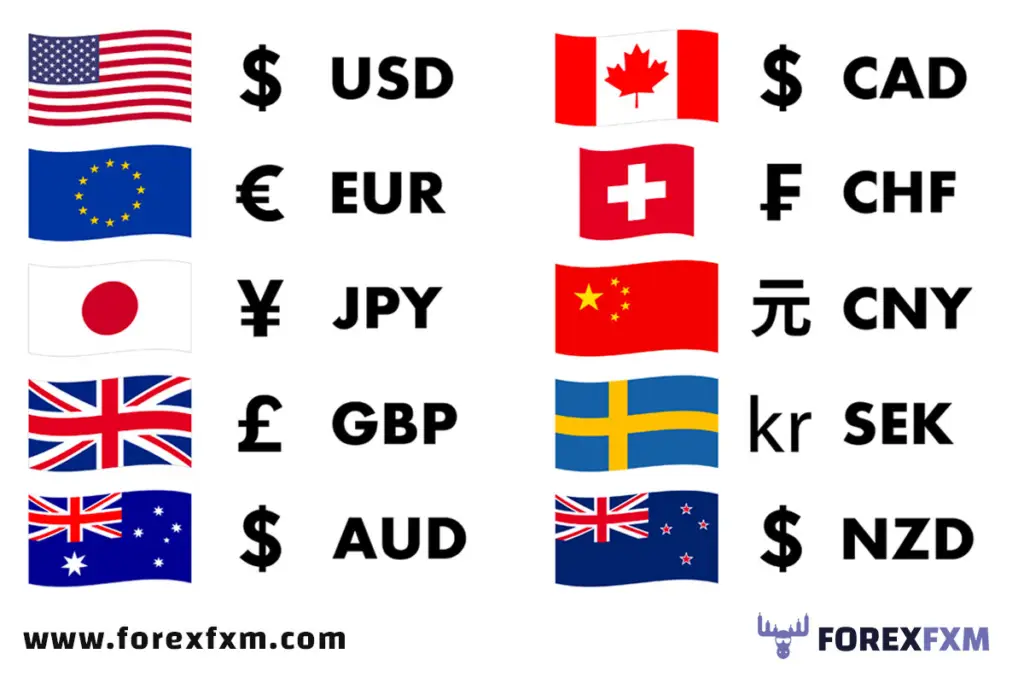

Each currency is assigned a specific code, making it easy for traders to identify it within a pair. Here are some codes for commonly traded currencies:

– USD: United States Dollar

– EUR: Euro

– GBP: British Pound

– JPY: Japanese Yen

– AUD: Australian Dollar

– CAD: Canadian Dollar

Furthermore, forex trading offers various lot sizes, such as standard lots (100,000 units), mini lots (10,000 units), and micro lots (1,000 units), accommodating traders with different risk preferences and capital levels. Understanding these basics is crucial for navigating the dynamic world of forex trading effectively.

What does it mean to buy or sell a currency pair?

When you buy a currency pair, it means you believe the price will go up, showing that the first currency (base currency) is getting stronger compared to the second currency (quote currency). On the flip side, selling a currency pair suggests you expect the price to drop, indicating that the first currency is weakening against the second.

For instance, let’s consider the EUR/USD pair. If you ‘buy’ it, you’re saying the Euro will get stronger against the US Dollar, so you’ll need more dollars to get a Euro. On the other hand, if you ‘sell’ this pair, you’re betting that the pound will weaken against the dollar, meaning you’ll need fewer dollars to get a single pound.

What means spread in Forex Trading?

In forex trading, the spread is the gap between the buying and selling prices. Imagine the buy price is 1.2426, and the sell price is 1.2424. For you to make money, the market price has to go higher than the buy price or lower than the sell price—depending on whether you bet the price would go up (long) or down (short).

What is margin in Forex Trading?

Margin refers to the initial deposit you need to commit in order to open and maintain a leveraged position. So, a trade on EUR/USD might only require a 0.50% margin in order for it to be opened. As a result, instead of needing $100,000 to open a position, you’d only need to deposit $500.

WHAT BROKER MUST I CHOOSE?

Selecting the right broker for your forex journey is crucial, and there are key factors to consider before making a decision.

Firstly, check the payment options the broker provides. Ensure they align with your preferences and offer secure and convenient methods.

Regulation is vital. Opt for brokers regulated by relevant authorities, as this adds a layer of security to your trading experience.

Consider withdrawal options. A good broker should make it easy for you to access your funds promptly when needed.

Evaluate the variety of trades offered. A broker with a diverse range of trading options allows you to explore different strategies and markets.

Now, it’s time to take the next step in your trading journey. Join our free trading signals and partner with our recommended broker to enhance your trading experience. Let’s navigate the forex market together!